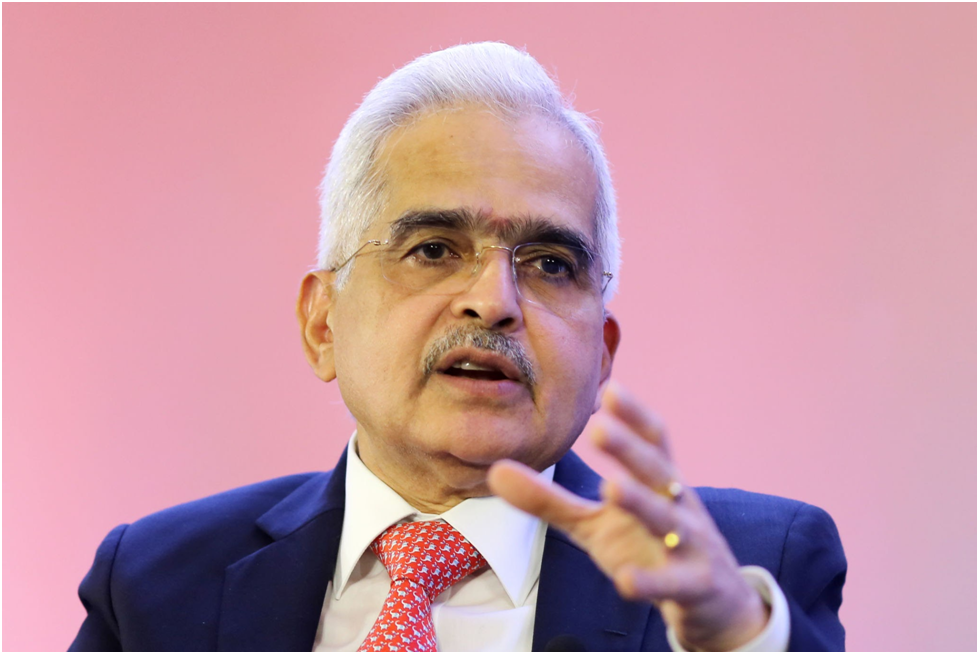

De-dollarisation not RBI’s objective: RBI governor Shaktikanta Das 5.

RBI governor Shaktikanta Das also mentioned that the idea of a currency for BRICS countries was floated by one of the countries

RBI’s Stance on De-dollarisation

Shaktikanta Das Clarifies RBI’s Position

RBI Governor Shaktikanta Das has made it clear that de-dollarisation is not a goal for India. He emphasized that the Reserve Bank of India has not taken any specific actions to move away from the US dollar. Instead, the focus has been on allowing the opening of Vostro accounts to facilitate trade in local currencies. This approach aims to reduce risks in trade rather than to eliminate the dollar’s role.

Vostro Accounts and Local Currency Trade

The introduction of Vostro accounts is a significant step for India. These accounts enable domestic banks to offer international banking services, which helps in trading with other countries using local currencies. This strategy is part of a broader effort to make Indian trade less dependent on a single currency, which can be risky due to fluctuations in value. The RBI’s main goal is to ensure safer trade practices.

Media Narratives vs. RBI’s Objectives

Das pointed out that some media narratives may misinterpret the RBI’s actions as a push for de-dollarisation. He stated that the real objective is to de-risk trade, not to abandon the dollar. The discussions around a common currency for BRICS nations have also been raised, but no concrete decisions have been made. The geographical diversity of BRICS countries presents challenges that need to be considered.

Understanding Vostro Accounts and Their Role

What Are Vostro Accounts?

A Vostro account is a special type of bank account that a local bank holds for a foreign bank. The term “Vostro” means “your account” in Latin. This account allows foreign banks to keep local currency, making it easier for them to do business in that country. These accounts are important for international trade and help in currency exchange.

Benefits of Local Currency Trade

Using Vostro accounts helps countries trade in their own currencies instead of relying on the US dollar. This can make trade smoother and reduce costs. For example, if an Indian company wants to buy goods from a Russian company, they can pay in rupees through a Vostro account. This way, both countries can avoid extra fees and complications that come with currency exchange.

Impact on India’s Trade Strategy

The use of Vostro accounts is part of India’s plan to make its trade more secure. By allowing trade in local currencies, India aims to lessen its dependence on one single currency, which can be risky. This strategy helps India manage its trade better and can lead to stronger economic ties with other countries.

BRICS and the Idea of a Common Currency

Challenges of a BRICS Currency

The idea of a common currency for BRICS nations has been talked about, but it faces many challenges. The geographical distance between the member countries makes it hard to create a single currency. Unlike the Eurozone, where countries are close together, BRICS nations are spread out across different regions. This spread can create issues in managing a shared currency effectively.

India’s Position on a Shared Currency

India has been cautious about the idea of a shared currency among BRICS nations. The Reserve Bank of India (RBI) has not made any moves towards this goal. Instead, the focus has been on strengthening trade ties through local currency agreements. This approach helps India reduce its reliance on the US dollar while still engaging in international trade.

Geopolitical Implications for India

The geopolitical landscape also plays a significant role in the discussion about a BRICS currency. With tensions between some BRICS nations and the United States, the idea of a common currency could be seen as a challenge to the dollar’s dominance. However, India must carefully consider the potential risks and benefits of such a move, especially in light of recent threats from the US regarding tariffs on BRICS countries. The situation remains complex, and India’s strategy will likely evolve as global dynamics change.

Internationalization of the Indian Rupee

RBI’s Steps Towards Rupee Internationalization

The Reserve Bank of India (RBI) is working to make the Indian Rupee more widely used around the world. Recently, they allowed payments for international trade to be made in rupees. This change, made on July 11, 2022, is seen as a big step towards making the rupee a global currency. Experts believe that if this system works well, it could greatly increase the rupee’s presence in international markets.

Potential Benefits for India’s Economy

By promoting the use of the rupee in global trade, India hopes to lower costs for businesses. When companies can trade in their own currency, they avoid the risks that come with changing exchange rates. This can help make trade smoother and more efficient, which is good for the economy. The RBI has also reported that banks from over 20 countries have opened special accounts to facilitate trade in rupees, showing growing interest in the currency.

Global Reactions to India’s Currency Strategy

The international community is watching India’s efforts closely. Some countries see the potential for the rupee to become a strong alternative to other major currencies. However, there are challenges ahead, especially in convincing other nations to adopt the rupee for trade. The RBI’s initiatives are part of a larger strategy to enhance India’s economic influence globally, and the success of these efforts will depend on how well they can navigate these challenges.

Conclusion

In summary, RBI Governor Shaktikanta Das has made it clear that moving away from the dollar is not a goal for India. Instead, the focus is on creating Vostro accounts and making agreements with other countries to trade in local currencies. This approach is aimed at reducing risks in trade rather than pushing for de-dollarization. Das emphasized that the idea of de-dollarization is more of a story being told by some in the media, and it is not something that is being actively pursued. The main priority remains to ensure that India’s trade is secure and not overly reliant on one currency.

8 comments